Taking a leap into the landscape of loans can be intimidating. , Yet, understanding the basics is essential to making informed decisions that work for you. Commence by thoroughly exploring different types of loans, such as personal loans, educational loans, and mortgages. Every type has its own criteria, interest rates, and repayment terms.

Furthermore, it's essential to compare your credit score before requesting for a loan. A high rating can secure more favorable terms.

- For the purpose of maximize your chances of loan approval, ensure that your financial documents are up-to-date.

- Carefully review the loan agreement thoroughly before committing. Comprehend all fees, interest rates, and repayment schedule.

- Be honest about your financial situation to ensure a smooth process.

Unlocking Your Homeownership Dreams: The Ultimate Home Loan Handbook

Are you dreaming of owning your very own home? The process to homeownership can seem overwhelming, but it doesn't have to be. Our ultimate Home Loan Handbook is designed to support you every step of the way. From comprehending mortgage options to acquiring favorable loan terms, this handbook provides crucial information to equip you to make informed decisions.

- Discover a wide range of mortgage options

- Gain the essentials of loan

- Master the application process with ease

Realize your homeownership dreams today! Order your copy of the Ultimate Home Loan Handbook now.

Embark on a Journey of Trust: Finding the Perfect Car Loan

Securing a car loan can be tricky process, but it doesn't have to be. By carefully considering your financial situation and exploring various loan options, you can find a loan that accommodates your needs and aids you drive away with confidence.

- First by evaluating your budget. Determine how much you can budget for in monthly payments and consider interest rates and loan terms.

- , Subsequently, investigate different lenders, contrasting their interest rates, fees, and repayment options. Consider both traditional banks and online lenders to find the best fit for you.

- , Once you've, choose a loan that aligns with your financial goals and offers peace of mind. Remember to carefully review the loan agreement before signing, ensuring you fully understand the terms and conditions.

Unlock Savings with a Refinance: Lower Payments & Reduce Interest

Are you finding it difficult to keep up with your monthly mortgage bills? A wise refinance could loans, home loan, car loan, refinance, personal loan, credit, credit rating, Debt consolidation, business loan, credit unions, broker, interest rates, lending be the key you need. By getting a new loan with more favorable terms, you can decrease your monthly payments and accumulate significant savings. A refinance can be a valuable asset to improve your financial well-being.

Dive into the benefits of refinancing and how it can revitalize your mortgage experience.{

Loans for Your Goals : Simplifying Your Finances

Achieving your aspirations if it's purchasing a dream, can often require a financial boost. This is where personal loans come into play. These versatile financial tools provide you with a lump sum of money, which you can allocate towards a wide range of goals.

Personal loans offer flexibility in terms of repayment schedules, allowing you to opt for a plan that aligns with your budget. They can significantly simplify your finances by combining multiple payments. By securing a personal loan, you can unlock cash flow and effectively control your overall financial health.

- Explore personal loans if you need funding for home improvements

- Shop around to find the best terms for your situation

- Understand the fine print before accepting any loan offer

Choosing Between Credit Unions and Banks: Finding the Perfect Fit

Deciding between a financial institution and a community bank can feel overwhelming. Both offer common financial tools, but their structures and priorities differ significantly. Traditional lending institutions are for-profit entities, often prioritizing financial gains. Community banks are not-for-profit organizations owned by their members, focusing on member benefit.

- Banks often offer a wider range of advanced financial tools, but may have stricter eligibility criteria.

- Credit Unions typically provide competitive interest rates, coupled with local decision-making.

Ultimately, the best choice depends on your individual banking goals and preferences. Research both options carefully to determine which aligns best with your situation.

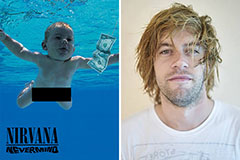

Spencer Elden Then & Now!

Spencer Elden Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!